The Republican reconciliation bill would trim Medicaid and the Supplemental Nutrition Assistance Program (SNAP). These are shared federal-state programs, with the federal government currently paying 69 percent of Medicaid costs and 93 percent of SNAP costs.

The proposed GOP reforms would have the states pay a modestly higher share of the costs, which has prompted worries that state budgets will be hammered and crushed.

- Politico: “financially hammer deep-red states.”

- Tax Policy Center: “major impacts on state finances.”

- Center on Budget and Policy Priorities: “crush state budgets.”

- Washington Post: “cuts could jeopardize … state budgets.”

- Senate Democrats: “vast hole in state budgets.”

- Some Senate Republicans: “significant burden … for a lot of our poorer states.”

- Senator Tommy Tuberville (R‑AL): states “can’t afford it … We don’t have printing machines back in our state, we can’t print the money.”

- Oregon Governor: states “do not have the kind of money that it would take to maintain (SNAP) at the current level.”

Are these valid concerns?

First, note that the comments belie a common belief that—somehow—funding from Washington is free, while state funding imposes a burden.

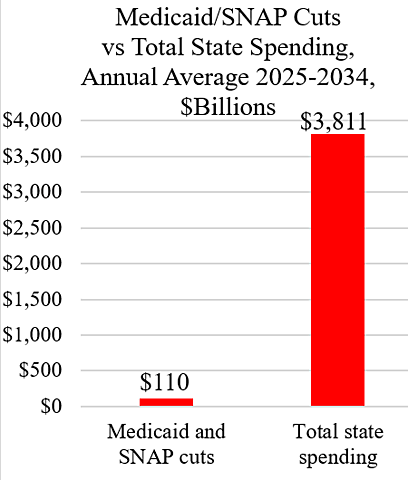

Now let’s look at the numbers. Compared to the baseline, the reconciliation bill would cut Medicaid about $80 billion annually and SNAP $30 billion annually over the next decade, on average. Total state spending in 2024 was $3.064 trillion. Assuming that state spending remains a constant share of the economy, it will average $3.811 trillion over the next decade, as shown in the chart.

Thus, the combined Medicaid and SNAP cuts of $110 billion a year will represent just 2.9 percent of total state spending. However, many of the proposed GOP reforms—such as beefed-up work requirements and eligibility restrictions—would save money, not shift burdens to the states, so the state budget impact would be less than 2.9 percent.

The proposed GOP reforms would not be hammering or crushing but rather would represent a small revival of fiscal federalism and fiscal responsibility.